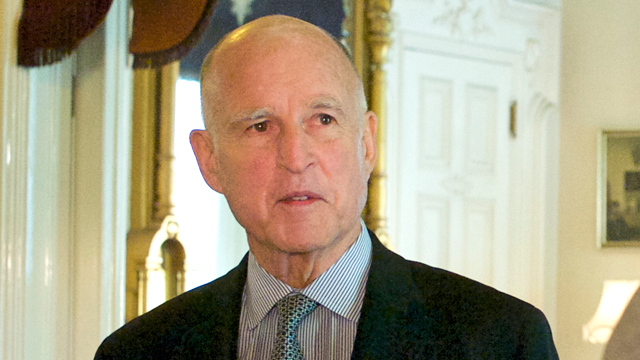

Gov. Jerry Brown made a rare appearance before a legislative committee Monday afternoon to lobby for his plan to require the state to save some excess tax dollars in a revamped rainy day fund.

Brown has made the proposal, which would be submitted to voters as a constitutional amendment this November, a top fiscal priority. He highlighted the plan in his January State of the State address and further elevated the issue by calling the Legislature into special session earlier this month

Brown argues that by trying to capture funds from periodic spikes in capital gains tax revenue, the plan could smooth out the deep deficits that have hit California when the economy weakens. Before the Assembly Budget Committee on Monday, he said that stability is worth the cost of forgoing several billions of dollars’ worth of spending on state programs.

“There is some curb, because if you don’t curb you’ll go back into this constant recurrence of debt,” Brown said. “Boom and bust, red and black.”

The Brown proposal would replace California’s current rainy day fund, which has been virtually ignored by governors and lawmakers since 2007. And it would bump a competing proposal, approved by the Legislature in 2010, off the November ballot.

Under the governor’s plan, whenever capital gains taxes make up more than 6.5 percent of the state’s general fund revenue, the excess would be steered into a reserve account. That account would max out at 10 percent of general fund tax proceeds. The proposal would allow the state to use some of that account to pay down debts and other liabilities, and it would set up a new reserve account to support school funding.