A new report from the UC Berkeley Labor Center finds that California workers are even less prepared for retirement than previously thought.

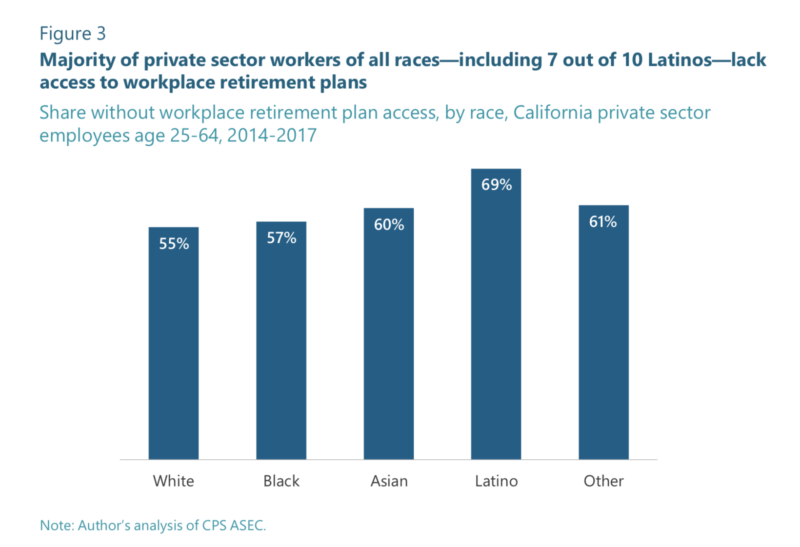

According to the report, 61% of California private sector workers don’t have access to an employer-sponsored retirement plan — meaning they would have to fund their retirement entirely on their own. And nearly half have no retirement assets at all, either through an employer or from their own individual accounts.

The report, which analyzed data from the U.S. Census Bureau’s Current Population Survey and its 2014 Survey on Income and Program Participation, found these numbers are particularly bad for Latino workers, who are “twice as likely as white workers not to own a retirement savings account or participate in a pension.”

“We’ve known for a while now that California is much worse off than even the national average,” said Nari Rhee, director of the Retirement Security Program at UC Berkeley and author of the report. “But even knowing that, it was pretty shocking to discover that half of California private sector workers basically have no retirement assets to their name. Whether it’s from a former employer or their own individual pension accounts. They just have nothing.”

Retirement funds — according to the report — have traditionally relied on a “three-legged stool” approach: Social Security, employer-funded pension programs and private savings.

But with Social Security funds unlikely to cover the bills, and as more companies move over to employee-funded 401(k) plans in lieu of pensions, many people are forced to rely more on their private savings.

However, the report points out that while families do accumulate assets over time, like home equity, their personal net worth is generally not enough to cover the level of income needed after retirement.

For some, especially low-income Californians, contributing to any kind of retirement program — employer-provided or not — can be difficult financially.

“We also have to recognize that stagnating and low wages in the state and nationally does make it difficult for people to save for retirement — plus the high housing costs in California,” said Ken Jacobs, chair of the UC Berkeley Labor Center. “So while it’s important that individuals save, we also as a society need to take steps to make it possible for them to do so.”

And even when workers have employer-provided retirement plans and are able to contribute to them, it can be difficult to determine how to do so.

“For instance, if you have a completely voluntary plan where you have to go to your employer or to the plan carrier and say, ‘I want to set up an account,’ for low-wage workers, more than half never get around to taking that step,” said Rhee. “The investment menus are very confusing and intimidating, so there are a series of behavioral obstacles.”

To help address these obstacles, California has started its own retirement program. On July 1, it rolled out CalSavers. Any employer with at least five employees who doesn’t already offer a retirement plan is required to either start one or provide employees with access to CalSavers. Workers would then be automatically enrolled.

And it’s not a moment too soon. As California’s population continues to age, there has been a marked increase in the population of homeless seniors with no safety net.

“We know we have challenging demographics of aging in California. So, we’re not only going to see more seniors — that population is going to roughly double over the next 15 years — but we’re also going to see a more traditionally vulnerable senior population in terms of demographics,” said Rhee. “So, more senior women, more seniors of color. And what we’re adding to that picture is that each wave of retirees is going to be retiring with less resources than the last.”