California sold only 37% of its allowances at the auction, which was held May 20. That was the lowest percentage since August 2016, when 35% of allowances were sold.

The California Air Resources Board, which oversees the program, released the results Thursday.

Demand for Fossil Fuels Plummets

California’s economy has rapidly constricted during the coronavirus pandemic, as a statewide stay-at-home order severely reduced business activity.

Refinery operations have contracted due to travel restrictions and reduced demand for gas. According to the state’s energy commission, gasoline production in California declined 47.5% between March and April.

Jet fuel production declined 68.3% during that time, and diesel production fell 33.2%.

Demand for natural gas has actually been higher during the pandemic compared to the same time period last year, likely due to colder weather rather than any impacts from the coronavirus. Commercial power usage has been way down, but with people sheltering at home, residential usage has been up.

With emissions reduced, businesses appear to find little need to buy credits that allow them to release more.

“I think that’s mainly what’s going on here,” said Chris Field, an earth scientist at Stanford. “Cap-and-trade is still a very effective way to drive emissions down. At the same time, it can generate revenues from important processes. It’s important not to overinterpret any mismatch between supply and demand during this really challenging period.”

Weaknesses in the Program?

But an undersold market could also signal that the state’s market is bloated with more allowances than are necessary, given the paucity of economic activity in the state.

“It’s basically the worst-case result,” said Danny Cullenward, an energy economist and lecturer at Stanford, referring to the latest auction. “Almost no revenue is coming into the state.

“The bad outcome will get blamed on COVID, but is much more the product of a weak program design that was vulnerable to surprises, with way too many allowances,” he said.

Field agrees the program might need to be adjusted, but he said it’s too soon to tell. As the state allows businesses to reopen, economic activity is expected to increase.

“It may be a long-term consequence of the pandemic is an opportunity to decarbonize more rapidly,” Field said. “I hope that’s the case, but I don’t think we should take a hit to the economy to indicate that.”

Katelyn Roedner Sutter, U.S. climate program manager for the Environmental Defense Fund, which co-sponsored legislation to create the cap-and-trade program in 2006, wrote in a blog post that the results “demonstrate the durability of cap-and-trade” because even when the program is underfunded, it still “provides a critical backstop, ensuring California’s targets for reductions in climate pollution are achieved.”

But the auction illustrates the “need to diversify funding for complementary climate investments,” she acknowledged. “Rather than relying solely on a program specifically designed to reduce emissions and lower mitigation costs (and therefore revenue), California should move toward ensuring climate priorities are a core part of the state’s long-term fiscal priorities.”

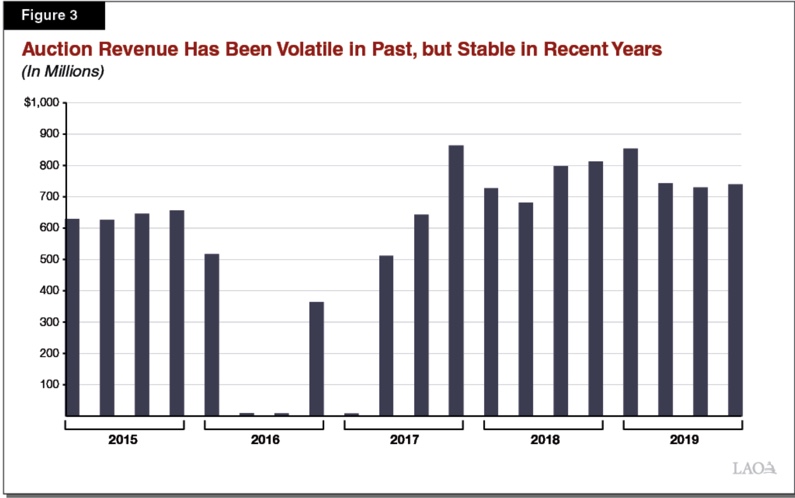

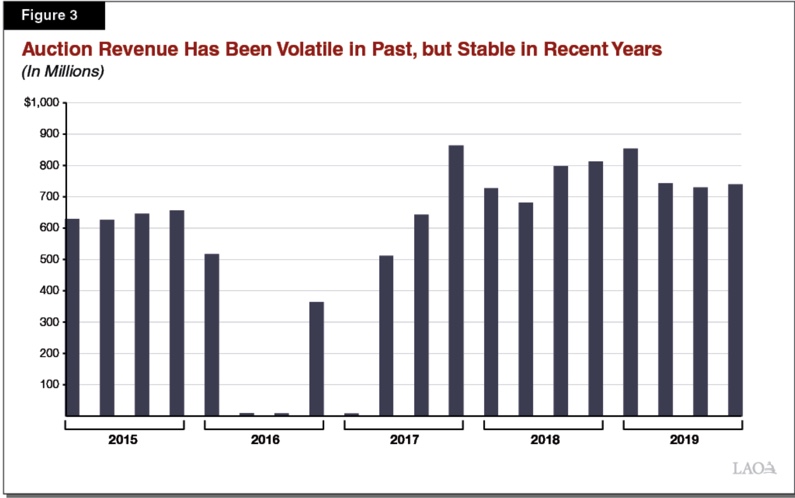

Twice in 2016 and once in 2017, California’s quarterly auction generated similarly low revenue. But for the last three years, the market has been stable.

Cuts to Environmental Programs

Because the state’s climate program is not generating revenue as expected, many of the state’s climate programs are facing the prospect of budget cuts.

California uses the money to clean dirty drinking water, encourage electric vehicles use and create programs that reduce emissions.

Gov. Gavin Newsom signaled uncertainty about cap-and-trade when he released his May revision to the state budget. The governor proposed a $965 million budget for the program, down from $1.4 billion last year.

But he acknowledged that California does not know how much revenue the program will generate this year and proposed spending the money as it comes in.

Jared Blumenfeld, secretary of California’s Environmental Protection Agency, said the agency would not be able to maintain current funding levels. “We are going to have to make hard decisions,” he said.

He said the state will prioritize initiatives to improve air quality in disadvantaged communities, fire prevention, and a program to clean up contaminated drinking water across the state.