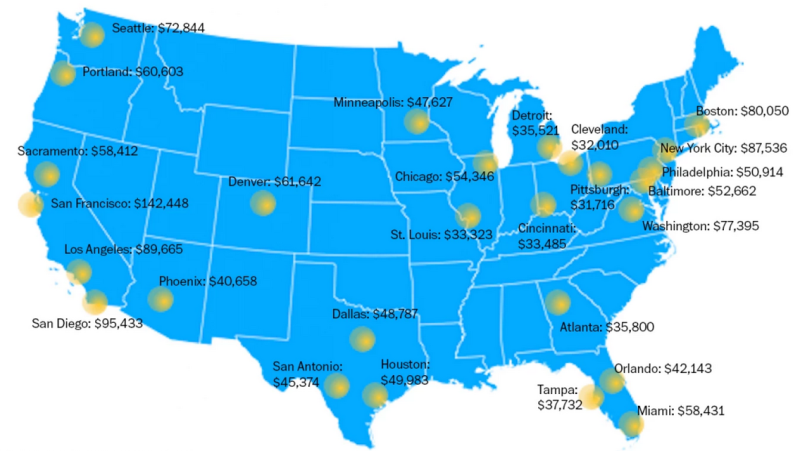

If you're looking for a bargain in housing -- or at least shelter that looks relatively inexpensive -- try Cleveland. Or Pittsburgh. Or Detroit, Cincinnati or St. Louis.

According to mortgage information site HSH.com, the median home price in each of those cities is under $140,000. At prevailing interest rates, you can get a 30-year fixed-rate mortgage with payments of $828 a month or less.

You know by now that buying or renting a place to lay your head in the Bay Area is an expensive proposition. San Francisco's Paragon Real Estate says regional median home sales prices ranged from $265,000 in Vallejo to $5.4 million in Atherton. HSH, using data from the National Association of Realtors, puts the regional median price for the final three months of 2014 at $742,900.

That's the number for the Census Bureau's San Francisco-Oakland-Fremont Metropolitan Statistical Area, which includes Marin, San Francisco, San Mateo, Alameda and Contra Costa counties. Median, as a reminder, means that half of the homes purchased in the Bay Area during that period sold for more than that figure and half for less.

HSH calculates that at a 30-year fixed rate of 4.02 percent and 20 percent down on that $742,900 home -- meaning an upfront payment of almost $150,000 -- your monthly mortgage payment would come to $3,323.79. And the before-tax income you'd need to pay the bank, your insurance company and your taxes? HSH pegs that at $142,448.33 (see the assumptions behind the numbers).