About one in five adults in America smokes.

And that's a significant drop from even a decade ago.

But disparities in smoking rates across economic, racial, educational, and gender lines remain wide. The graphic below - from the U.S. Centers for Disease Control and Prevention - is based on 2010 U.S. smoking data among adults:

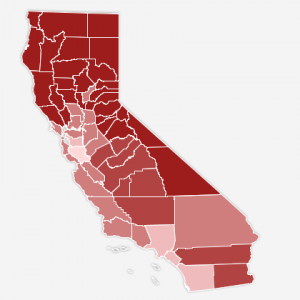

Who smokes in California?

In the last two decades, California's overall adult smoking rate has dropped roughly 40 percent. Among current smokers, income and education level (much more than race) still remain the two biggest predictors of who smokes. The California Tobacco Control Program survey, using data from 2008, found that:

- Poorer counties have significantly higher smoking rates: Tehama County, among California's poorest (with a poverty rate around 20 percent), had the highest adult smoking rate - almost 23 percent. Marin County, one of the richest regions in the state, had the lowest rate - just over 7 percent.

- Poorer households have higher smoking rates: Households with annual incomes exceeding $150,000 had a smoking rate under 8 percent, compared with a nearly 20% rate among those with annual incomes less than $20,000.

- Education level plays a big role: The smoking rate among college graduates in California is 6 percent. Those without degrees: 12 to 15%!

- Smoking rates are higher in rural areas: Rural regions had a higher smoking rate (nearly 16 percent) than suburban and urban areas (nearly 11 percent). Interestingly, the two exceptions were San Francisco and Sacramento Counties, both of which had rates above the state average.

So why should you care?

Disparities in the state's smoking rates bring up an interesting issue. Like most kinds of taxes - including gas, sales and property - a tobacco tax is considered regressive: one that takes a larger percentage of income from lower income groups than higher income groups. Because all smokers pay the same amount of tax for a pack of cigs, the price burden is heavier on poorer smokers than richer smokers, and it becomes more so as the tax goes up. For instance, if the tax on a pack of cigarettes were $2, and your weekly budget was only $10, that tax would be one-fifth of your entire budget. However, if your budget was twice that - $20 - the same tax would only be one-tenth of your budget. So ... the more money you have, the less you feel the cost of the tax. And, of course, if you don't smoke, you don't have to pay the tax at all.

Because in California there are more lower income than higher income people who smoke, an increase in the tobacco tax would have a lot more impact on lower income populations. The opposite of a regressive tax is called a progressive tax - one that that takes a larger percentage of income from higher income groups. Income tax - in which you pay a percentage of your income - is really the only true example of a progressive tax in our current tax system.

On November 8, California voters decide on Proposition 56, which would more than double the state's tobacco tax. Some opponents argue that a tax like this unfairly burdens and penalizes the state's poorer populations, who proportionally smoke more. Richer populations, whose smoking rates are much lower, will be less affected. The counterargument, of course, is that those same lower-income populations are already very burdened by high rates of smoking-related illness and subsequent medical costs. Increasing the tax on cigarettes will effectively discourage more people - especially youth - from smoking, especially folks who, financially, are less able to afford it. Advocates of the tax also point to the hefty burden that smoking-related illnesses place on the state's public health care system, a huge cost shared by all California taxpayers - smokers and non-smokers alike.