Real Estate

Donating marketable real estate, such as a personal residence or vacation home, commercial property, or even vacant land, can be a creative way to make a significant gift to KQED and at the same time receive important tax benefits and even income. The benefits include a charitable income tax deduction, avoidance of capital gain tax at the time the gift is made, and removal of the property from your estate, potentially reducing estate taxes and probate costs. A gift of your real property can also relieve you of the burden of managing or selling the property.

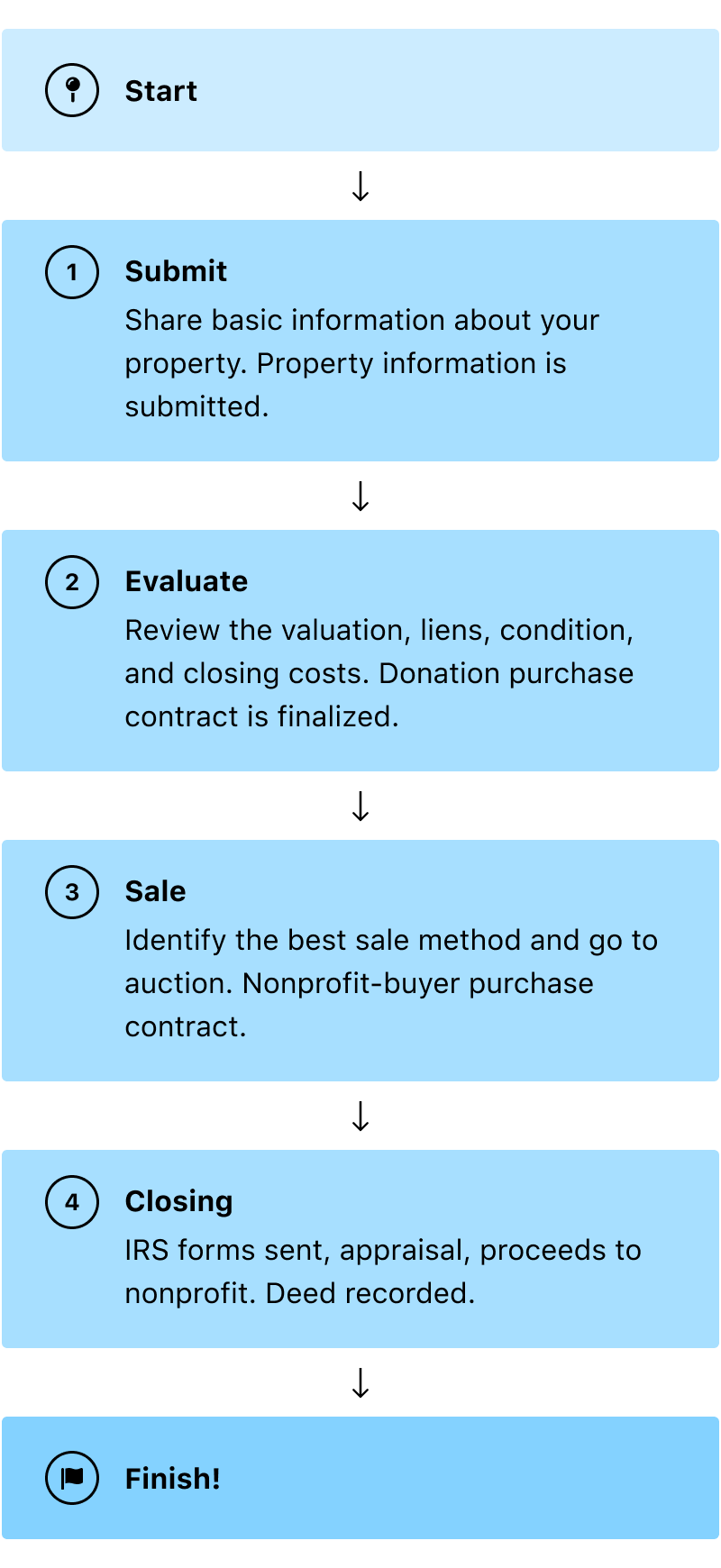

How It Works

KQED partners with CARS (Charitable Adult Rides & Services) to process real estate donations to benefit KQED. Our program takes any property type (land, homes, commercial) in any location so long as there is equity. Even if you owe back taxes, have a mortgage balance, or deferred maintenance, it’s no problem. We’ll pay off all loans, liens, commissions owed and pay all closing costs. If you have a real estate asset that is costing you money or not being utilized, donating it is a great way to give back and you may even claim a significant tax deduction!

Types of Real Estate Gifts

Outright Gift

Your benefits from an outright gift of real property would include an income tax deduction for the property’s full fair market value, removal of the property from your estate, and the reward of seeing your gift go to work for public broadcasting.

Charitable Remainder Trust

If you still need the income generated by the property, a charitable remainder trust may be a good solution. The property is irrevocably transferred into a trust and sold, and the proceeds are reinvested to generate the earnings from which to pay you income for life or a term of years. After that, the remaining principal goes to support the many KQED programs you have enjoyed over the years. Additional benefits include a substantial income tax deduction in the year the trust is established and no capital gain tax at the time of the gift.

Partial Interest Gift

If you do not wish to donate the entire property, you may deed to KQED an undivided partial interest. Alternatively, you may use such a partial interest to fund a charitable remainder trust. Typically in both instances, the entire property is sold, with the proceeds being shared proportionally between you and KQED, or between you and the charitable remainder trust. Your charitable deduction for the gift portion can help offset the capital gain tax on your portion of the property sale proceeds.

Retained Life Estate

You may give KQED your personal residence, but retain the right to live in it for your lifetime. A retained life estate will give you an income tax deduction in the year you make the gift and the satisfaction of making an important gift during your lifetime.

Bequest

You can make a testamentary gift of real estate through your will or trust.

Donate Real Estate

Still have questions? Talk to a real person.

Get a personalized illustration of how a gift of real property would work for you.