The U.S. rushed to seize the assets of Silicon Valley Bank on Friday after it experienced a run on the bank, the second biggest bank failure in history after Washington Mutual during the height of the financial crisis more than a decade ago.

Silicon Valley, the nation’s 16th-largest bank, failed after depositors — mostly technology workers and venture capital-backed companies — hurried to withdraw money this week as anxiety over the bank’s balance sheet spread.

Silicon Valley was heavily exposed to the tech industry, and there is little chance of contagion in the banking sector similar to the chaos in the months leading up to the Great Recession more than a decade ago. The biggest banks — those most likely to cause a systemic economic issue — have healthy balance sheets and plenty of capital.

In 2007, the biggest financial crisis since the Great Depression rippled across the globe after mortgage-backed securities tied to ill-advised housing loans rippled from the U.S. to Asia and Europe. The panic on Wall Street led to the collapse of the storied Lehman Brothers, founded in 1847. Because major banks had extensive exposure to one another, it led to cascading disruption throughout the global financial system, putting millions out of work.

However, there has been unease in the banking sector all week, and the collapse of Silicon Valley pushed shares of almost all financial institutions lower Friday, when they’d already tumbled by double digits since Monday.

Silicon Valley Bank’s failure arrived with incredible speed, with some industry analysts on Friday suggesting it was a good company and still likely a wise investment. SVB executives were trying to raise capital early Friday and find additional investors. However, trading in the bank’s shares was halted before the opening bell due to extreme volatility.

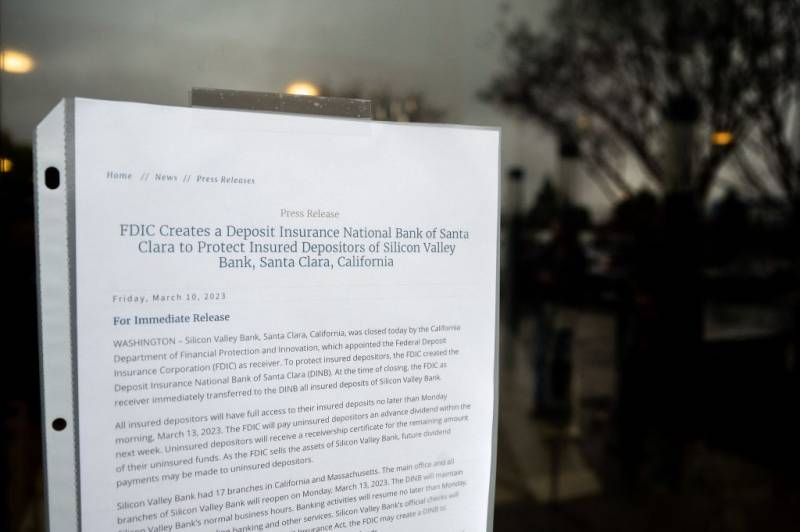

Shortly before noon Eastern Time, the Federal Deposit Insurance Corporation moved to shutter the bank. Notably, the FDIC did not wait until the close of business to seize the bank, as is typical in an orderly winding down of a financial institution. The FDIC could not immediately find a buyer for the bank’s assets, signaling how fast depositors had cashed out. The bank’s remaining uninsured deposits will now be locked up in receivership.