Last year eight other states, temporarily at least, banned flavored e-cigarettes, prompting legal challenges. Several states similarly prohibited the sale of flavored cannabis products. So far in 2020, of at least 184 vaping bills in 20 state legislatures, 47 include flavor restrictions, according to the National Conference of State Legislatures.

At least 60 California cities and counties have taken matters into their own hands by banning flavors or restricting the sale of e-cigarettes. In San Francisco, the first e-cigarette sales ban in the nation went into effect in January.

“Politics gets down to money,” said Jim Knox, director of government relations for the American Cancer Society Cancer Action Network. “The tobacco industry has been for decades, and remains, a very substantial power at the state Capitol.”

Tempting Flavors Attract Younger Users

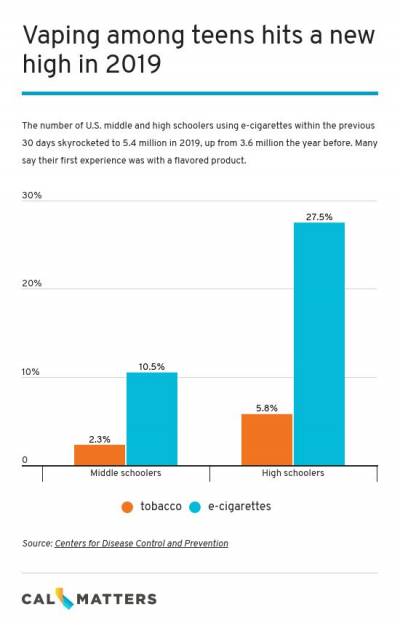

When e-cigarettes hit the U.S. market in 2007, there was little regulation of sales, advertising or use. They were typically touted as a tar-free alternative to smoking, a way to reduce cigarette consumption. But they also surged in popularity among new, younger users. As of last year, 1 in 10 middle-schoolers and a quarter of high-schoolers reported using e-cigarettes in 2019, according to the Centers for Disease Control and Prevention.

Among recent users in middle school, 49% said they used a flavored product in 2018. Among high school tobacco users that number was 67%.

That led some California legislators to try to regulate vaping — triggering fierce opposition from tobacco companies and the vape industry.

Last year in the Assembly, a bill to ban the sale of flavored tobacco products was killed without even a hearing in the Assembly’s Government Organization Committee, chaired by Merced Democrat Adam Gray.

The committee is “the main vise the legislative leadership has used to deliver for big tobacco,” said Stanton Glantz, UC San Francisco professor of medicine and director of its Center for Tobacco Control Research and Education.

“Of all the tobacco control policies that are out there,” Glantz continued, “the one they are most desperate to stop is flavor bans. Because that goes to the key of how they get all of these kids addicted.”

A similar 2019 flavor ban proposal in the California Senate grew so weakened by amendments that its author abandoned the bill.

Then reports of vaping tragedies nationwide began mounting — as of last week, vaping had caused 2,600 hospitalizations and 60 deaths nationwide. The majority of those who became sick were vaping tetrahydrocannabinol, or THC, a cannabis product, according to the Centers for Disease Control and Prevention, which identified the culprit as the additive vitamin E acetate. But the mounting health toll heightened awareness of the rising trend of teens vaping cannabis and tobacco.

President Trump initially called in September for a ban on all flavored e-cigarette products, but then backpedaled. Instead, in January his administration issued a more limited mandate that manufacturers stop selling certain products, such as prefilled flavor pods. Exempted are menthol cartridges and also tank-based systems that allow users to refill vape pens with their choice of flavored liquid.

A few days after Trump’s September announcement, Gov. Gavin Newsom issued an executive order directing various California agencies to crack down on the vaping black market, research new ways to tax vape products and develop a $20 million awareness campaign about the risks of vaping.

The governor also has said he supports a new flavor-ban bill sponsored by the same senator whose bill was stymied last year — and like last year’s, the new state bill would bar more types of flavored products than the Trump administration has restricted.