The company paid for ads promising customers could get their credit checked over the phone, a tactic designed to avoid the embarrassing experience of having a loan denied in person. Call center operators had detailed scripts, which would include telling customers to "please hold while I process your application," only to return five seconds later to congratulate them on meeting the credit criteria for "several of our lenders."

But Becerra says an unnamed manager at the call center said operators would not process loan applications at all. Instead, the act was a ruse to collect information and generate sales leads.

Once customers arrived at the dealership, Becerra says the company would lie about how much money a potential borrower earned each year to deceive lenders. An audit by one finance company found that out of 320 incomes reported from the company's location in Fresno, more than 78% of them were inflated by at least $500 per month.

Becerra also said the company made lots of money by selling optional add-ons, such as insurance or service contracts, by falsely telling customers they were required by law. In some cases, Becerra said customers did not know they were purchasing add-ons because employees would hide the paperwork by placing their hands over the disclosures — a technique employees at the dealership referred to as a "hands-down close."

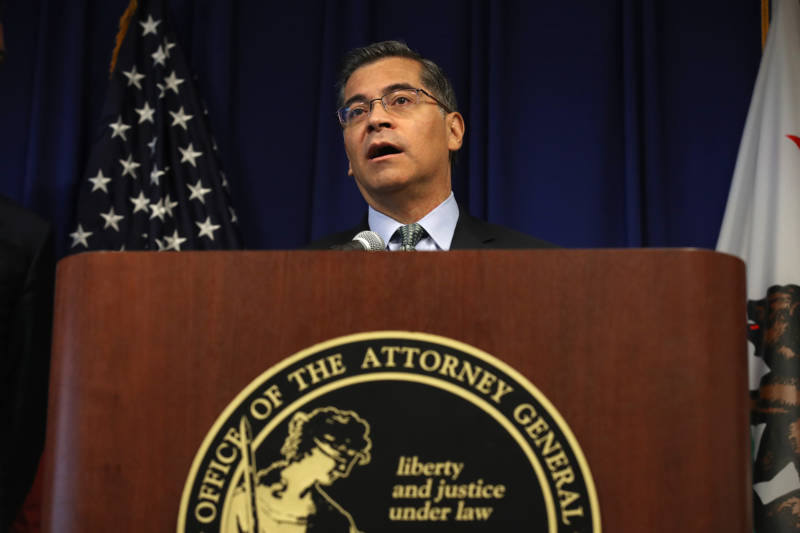

"We're talking about hardworking families who make every dollar count, seeing their hard earned money swindled away by dishonest tactics that put them in unaffordable debt," Becerra said.

All of this, Becerra says, is endorsed and encouraged by the company's senior management, including Paul Blanco himself. The complaint said some employees who objected to the techniques were fired while others were warned not to be a "snitch."

"During sessions one manager called 'lessons in larceny,' Paul Blanco's taught employees to lie to third-party lenders in order to obtain consumer if financing on false pretenses and boost dealership profits," according to the complaint, written in part by Hunter Landerholm, a deputy attorney general who is handling the case.

Landerholm said the attorney general's office is not asking a judge to shut the company down while the lawsuit is pending. But they are asking a judge to order the company to stop using these techniques and to make them pay restitution plus civil penalties.

The defendants include the company and Paul Blanco himself.

Becerra said he does not know how many customers were impacted, urging anyone who was impacted to contact his office.

This version corrects that the company has seven dealerships in California and two in Nevada, not seven in California and Nevada.