Seth Frotman spent years dealing with the fallout of the education debt crisis as the student loan ombudsman for the federal Consumer Financial Protection Bureau before resigning in protest in the wake of President Donald Trump’s election.

As Trump Rolls Back Student Loan Protections, An Obama-Era Watchdog Brings the Fight to California

Now he’s bringing his borrower-protection crusade to California.

The state’s massive population and reputation for consumer protection, he says, make it the perfect laboratory for testing whether more regulation of loan servicers can keep student debt in check.

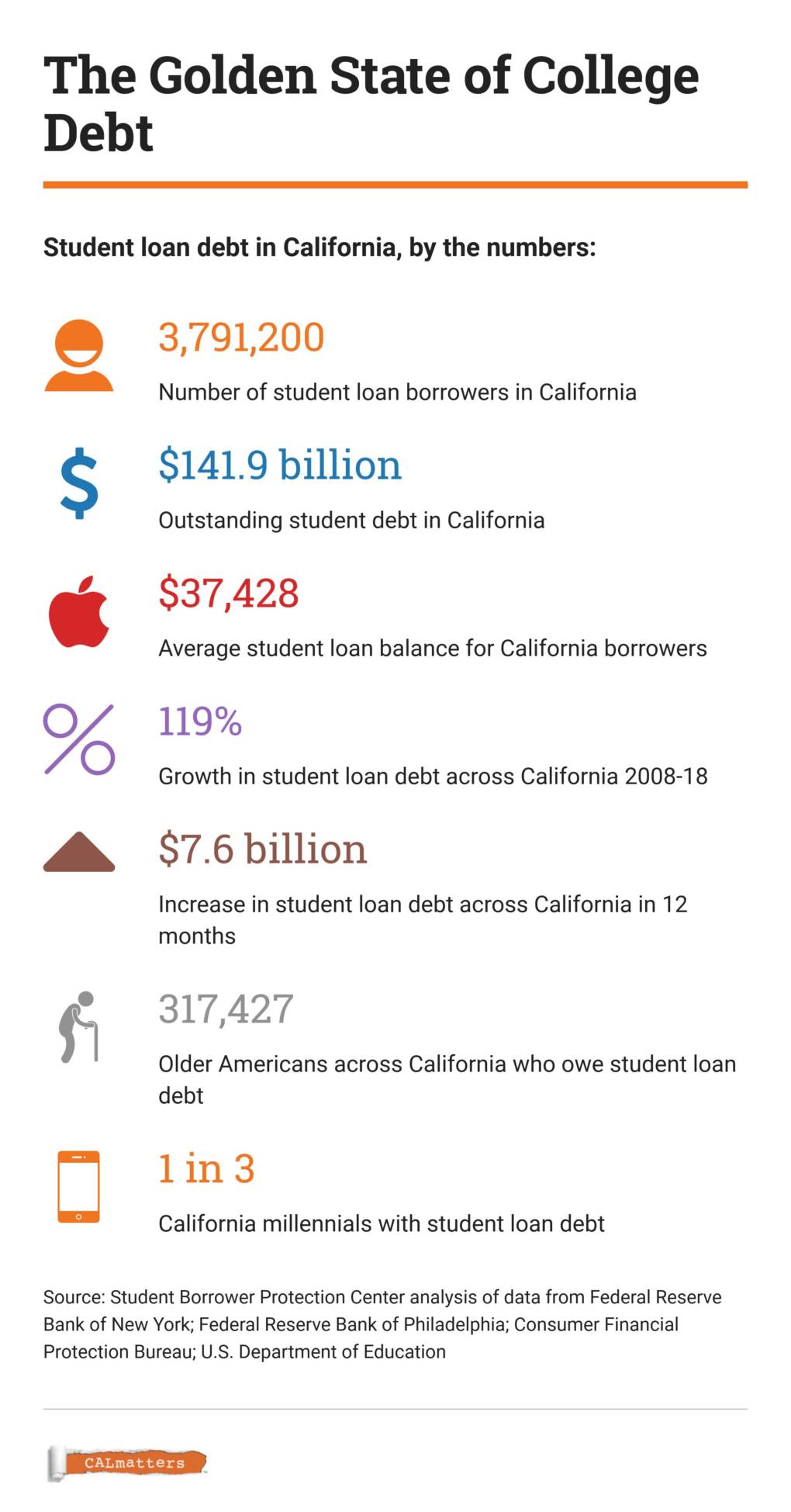

Californians hold about a tenth of the nation’s $1.5 trillion in student debt, according to data compiled by Frotman’s non-profit, the Student Borrower Protection Center. The group is sponsoring a bill in the Legislature that would establish a borrower’s bill of rights, hire a state borrower advocate to respond to consumer complaints and monitor loan servicers’ performance.

Carried by Assemblyman Mark Stone, a Democrat from Scotts Valley, the legislation, which advanced out of the Assembly Banking Committee on Monday, wouldn’t keep students from taking on debt, but Frotman believes it could combat the kinds of servicer abuses he saw while working for the federal government.

“This is a generation that gets a bad rap,” said Frotman. ‘“Oh, you have too much student debt because you eat too much avocado toast.’ But that couldn’t be further from the truth.”

The 60,000 student borrower complaints Frotman and his team handled, he says, “reflected people desperately trying to pay their bills and running into traps at every point.”

Among the problems Frotman documented: Companies applying payments in a way that increased fees and interest. Borrowers who were transferred to a new servicer and no longer got credit for payments they’d already made. Borrowers who were eligible for an income-based repayment plan but didn’t realize it, and ended up going into default.

California is currently suing Navient, one of the country’s largest student loan servicers, alleging that the company failed to advise struggling borrowers that they were eligible for reduced payments, instead steering them into forbearances that delayed repayment but allowed interest to accumulate.

The Student Loan Servicing Alliance, an association of major servicers, opposes the legislation but did not respond to requests for comment or send a representative to the committee hearing where Stone’s bill passed Monday. The measure now heads to the Assembly’s appropriations committee.

Assemblyman Steven Choi, a Republican from Irvine, was among those who chose not to vote on the bill, saying he feared it would encourage frivolous lawsuits.

California undergraduates take out smaller loans on average than those in most other states — in part due to the state’s relatively generous financial aid. But student loan debt in the state still has more than doubled since 2008, and disproportionately affects low-income communities and people of color.

A study released Tuesday by the Federal Reserve Bank of San Francisco and that city’s treasurer, found that one in six Bay Area borrowers had defaulted in the past 15 years. In the neighborhoods with the highest concentration of black and Latino residents, the default rate was over 23 percent.

California last year began requiring all student loan servicers to be licensed by the state’s Department of Business Oversight. But Stone, who also authored that legislation, said that only some servicers are complying.

Top 10 Bay Area ZIP codes with the highest percentages of student loan borrowers who are 90+ days delinquent (March 2018)

Source: FRBNY Consumer Credit Panel/Equifax Data; American Community Survey (via Student Debt in Bay Area report)

“They are essentially thumbing their nose,” he said at Monday’s hearing. “They’re operating in their own best interest, not in the interest of borrowers.”

The country’s skyrocketing student loan debt has increasingly drawn the attention of national policymakers. U.S. Sen. Elizabeth Warren, D-Massachusetts, who’s running for president in 2020, made headlines this week when she proposed canceling student debt for most borrowers and eliminating tuition at public colleges.

Rather than upending the student loan system as Warren proposes, the California bill would cope with some of its worst consequences, said Sandy Baum, a fellow at the Urban Institute who studies college access and pricing.

“It says, ‘We know students have debt, we know debt is manageable for many students, but we also know students run into problems, and we want a support system for those students.’”

If the bill passes, California could once again provide an example for states looking to increase their own oversight powers amid a steep decline in federal enforcement of consumer protection laws.

“The federal government is not going to ride to the rescue,” said Frotman. “There is no cavalry on the horizon.”

This story and other higher education coverage are supported by the College Futures Foundation.

CALmatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.