The bill placed a tax of 12 cents on each gallon of gas and 20 cents on each gallon of diesel sold in California -- and it increased car registration fees from between $25 and $175, depending on the value of the car.

Total taxes from SB 1 would bring in about $5 billion per year over the next decade. The money is split between the state government and local governments to fix transportation infrastructure projects around California.

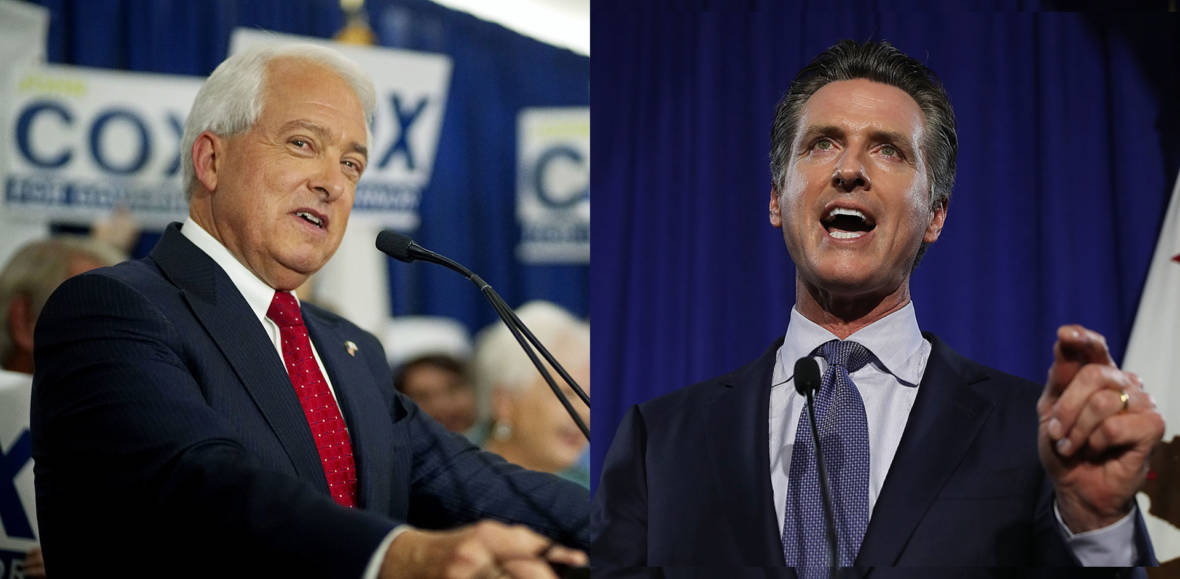

Newsom said Cox's plan would worsen traffic conditions in California, a state that already has some of the worst congestion in the U.S., and called Cox's notions about implementing efficiencies in Caltrans "illusory."

"The fact is the Legislature and the governor finally began to address this issue in a substantive way," Newsom said. "He's talking about taking away over $5 billion every single year for road improvements, public safety improvements, addressing the issue of traffic and congestion, which, in and of itself, is a hidden tax. And to reconcile the fact that 27 other states since 2013 have increased their sales tax, or rather gas taxes, in an effort to improve their roads, he chooses not to do that. He talks about the illusory notion of efficiencies."

Cox said other untapped sources of money could be identified to fund transportation infrastructure.

"This state is running a surplus right now, and it generates tens of billions of dollars from motor vehicle-related sources -- sales taxes on cars and other things like that aren't being used. We have a surplus," Cox said. "Why are we digging into the pockets of people who were already paying the highest housing prices, the highest water prices, the highest electricity prices in the country?"

Newsom, who has served as lieutenant governor under Gov. Jerry Brown, said he was proud of the Brown administration's record, having adopted a $27 billion budget deficit in 2010, turning it into a $8.5 billion budget surplus today. He said California under Brown now has the lowest rate of unemployment in recorded history and an average of 3.7 percent GDP growth over the last four years.

"The difference between myself and my opponent, John Cox, is we actually have strategies and plans to address those issues, and with respect to the illusory notion of 'efficiencies' at Caltrans, I can assure you that's not going to build any road or bridge," Newsom said.

When asked about possible future downturns in California's economy and what would happen if $50 billion were stripped from the state budget to fix roads, Cox said he'd look more broadly at the state's budget.

"We've got to get a look at every expense that we incur," Cox said. "We've got to audit every agency and we've got to root out the waste in this budget. And believe me there's a lot of it. This budget has increased tremendously, and there's a tremendous amount of waste and mismanagement that's going on in this budget."